Gold, renowned for its reliability as an asset class, delivered impressive double-digit returns in 2022. As investors seek opportunities to diversify their portfolios, they often turn to this precious metal.

Have you ever considered Sovereign Gold Bonds (SGBs) as an alternative to physical gold? Not only do SGBs offer the potential for gold returns, but they also provide an additional 2.5% interest and tax exemptions when held to maturity.

Let’s get into the details and further understand SGBs as an investment product.

What Are Sovereign Gold Bonds (SGBs)?

In November 2015, Sovereign Gold Bonds (SGBs) were introduced as a scheme to address the excessive demand for physical gold. Surprisingly, Indians purchase approximately 300 tons of gold every year!

SGBs were designed to serve as an alternative to owning physical gold, offering a more convenient and secure investment option.

Key Features of SGBs

- Value Measured in Grams of Gold: SGBs are government securities with their value denominated in grams of gold. This allows investors to track their investment in terms of the precious metal’s weight, providing a tangible connection to the market.

- Cash Purchase and Holding Certificate: Investors are required to pay the issue price of SGBs in cash. In return, they receive a holding certificate that confirms their ownership of the bonds. This certificate acts as proof of investment.

- Redemption for Cash: On maturity, SGBs can be redeemed for cash. This feature ensures that investors can easily convert their investments into liquid funds, providing flexibility and convenience.

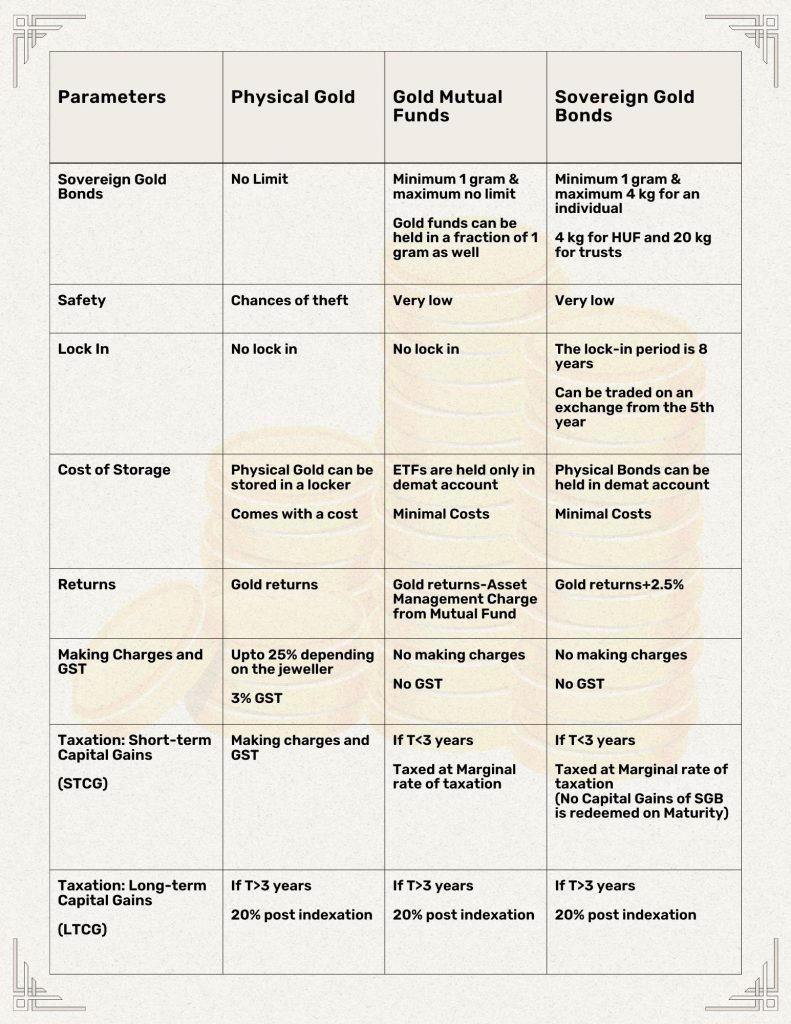

How Sovereign Gold Bonds (SGBs) compare with other gold products

Let’s take a closer look at the available options for investing in gold:

Sovereign Gold Bonds (SGBs) present a compelling case for investment. Here’s why:

1. Fixed Interest Payments:

• SGBs offer a fixed interest rate of 2.50% per annum, paid semi-annually. This steady income stream makes them particularly appealing compared to physical gold, which does not generate regular interest payments.

• The interest rate is calculated based on the initial investment amount, ensuring a predictable return on investment.

2. Flexible Tenor and Exit Option:

•SGBs have a tenor of 8 years, providing investors with a long-term investment opportunity.

• However, there is an exit option available from the 5th year onwards. Investors can choose to redeem the bonds during the 6th or 7th year or hold them until maturity in the 8th year.

• This exit option allows investors to access their funds earlier if necessary, striking a balance between long-term commitment and liquidity.

3. Ability to Sell on Exchanges:

• SGBs can also be sold on the exchanges, providing investors with an additional avenue to liquidate their investments.

4. Minimum Investment and Subscription Limits:

• Investors must purchase a minimum of 1 gram of gold when investing in SGBs, allowing for greater accessibility and affordability.

• Individual investors are limited to a maximum subscription of 4 kilograms per fiscal year, ensuring fair distribution and preventing the concentration of holdings.

Income Streams of SGBs

SGBs offer different avenues to earn an income:

• Interest income

• Redemption income

• Income from selling in the secondary market

Interest Income:

• SGBs provide semi-annual interest income, which is taxable. The interest income is treated as additional income, similar to Fixed Deposits (FDs).

• Depending on the individual’s tax bracket (10%, 20%, or 30%), the post-tax return on the interest comes to 2.25%, 2%, and 1.75% respectively.

Redemption Income:

• After the 5th year, investors have the option to redeem the bonds in the 6th, 7th, or 8th year. This redemption income can generate profits if the bond price at the time of redemption is higher than the purchase price.

• Notably, the resulting capital gain upon redemption is tax-exempt for individuals, offering a distinct advantage over physical gold investments.

Income from selling in the secondary market :

• SGBs can be sold in the secondary market, allowing investors to capitalize on market fluctuations and potentially generate additional profits.

• However, it’s important to note that any capital gains arising from secondary market transactions are subject to taxation and are not exempt.

Conclusion

Sovereign Gold Bonds (SGBs) present an appealing investment avenue to help investors with asset allocation. By offering additional interest payments, exemptions from the capital gains tax, and the ability to sell on exchanges, SGBs combine the benefits of gold investment with the convenience and flexibility of a financial instrument.

However, it’s crucial to consider the 8-year lock-in period when deciding whether SGBs align with your investment goals.

Ultimately, SGBs offer a unique way to embrace the allure of gold while enjoying the advantages of a modern investment product.

If you found this article useful, do check our blog regularly for insightful content on personal finance, investments and taxation.

And did you know that MProfit helps you auto-import & track all your investments including Sovereign Gold Bonds in one place?

Sign-up for MProfit now at the link below:

Sign Up | MProfit

Comments