Introduction

With the tax deadline just around the corner, it’s time to gear up and file your tax returns for the financial year 2023. The last date for filing tax returns is July 31, and if you haven’t filed your returns yet, now is the time to get started. One crucial aspect of filing your returns is choosing the correct Income Tax Returns (ITR) form. It can be confusing to pick the right one.

In this blog, we’ll provide you with details on the different types of ITR forms to help you determine which form is right for you.

So let’s get started!

There are 7 ITR forms:

ITR-1 or SAHAJ, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6 and ITR-7.

ITR-1 to ITR-4 are used for individual tax filing.

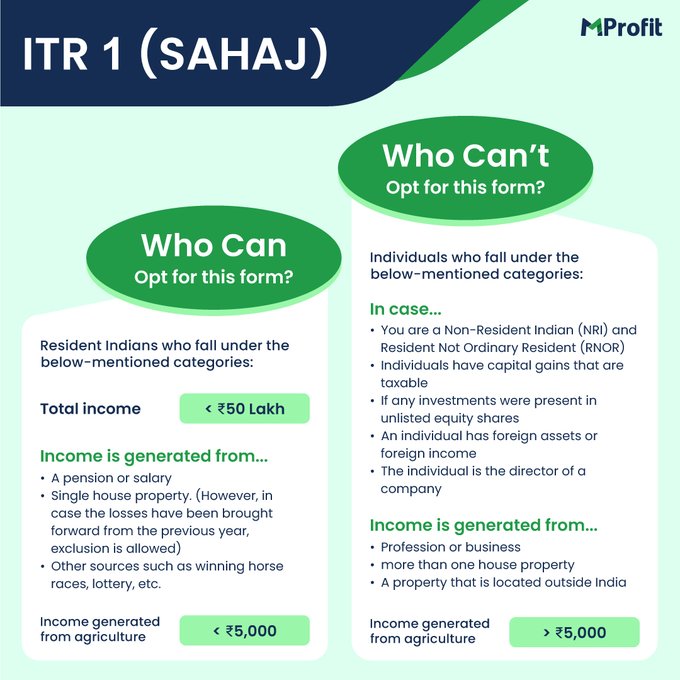

ITR-1 or SAHAJ: The Simplified Form

If you’re a resident Indian with an income below 50 lakhs and don’t have capital gains, ITR-1 or SAHAJ is the form for you. This user-friendly form is tailored to suit individual taxpayers with simple income sources.

Here is an overview of ITR-1:

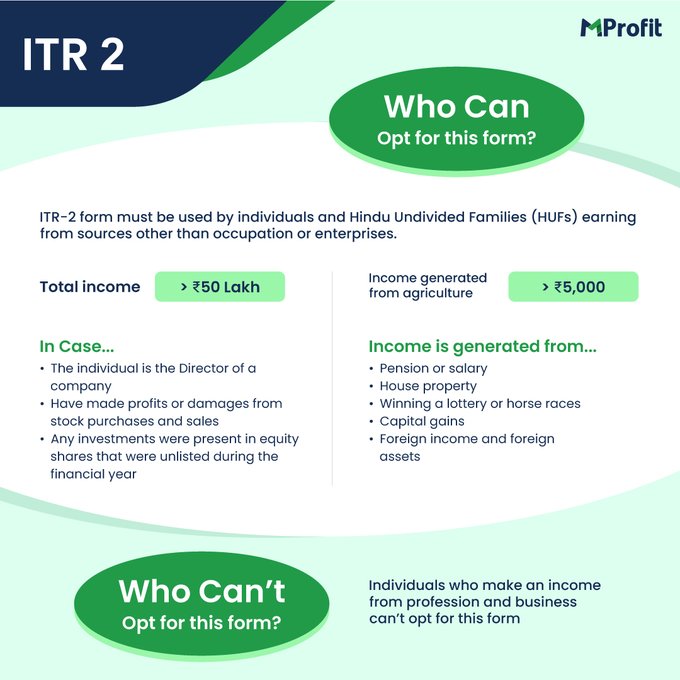

ITR-2: For Higher Income Earners

For resident Indians and HUFs with income exceeding 50 lakhs but no capital gains, ITR-2 is the appropriate form. This form caters to individuals with more diverse income streams and complexities.

Here’s an overview of ITR-2:

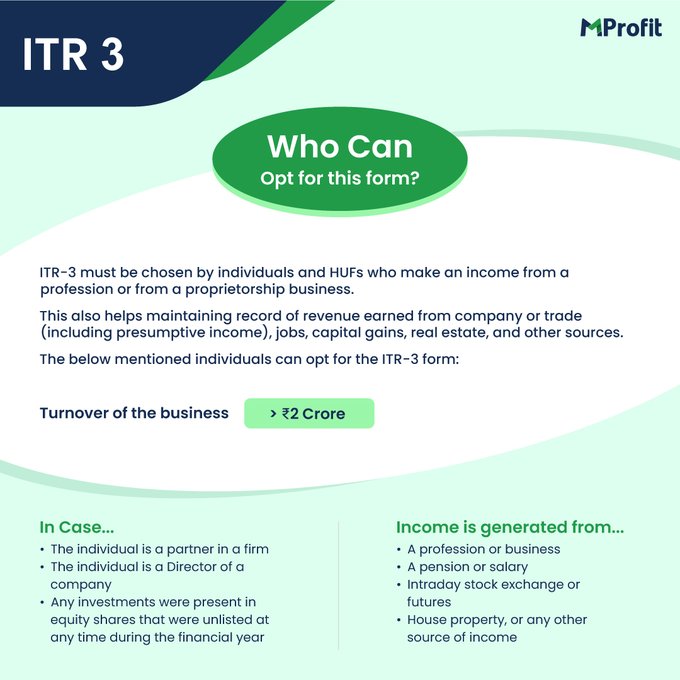

ITR-3: For Business Professionals

ITR-3 is designed for individuals and Hindu Undivided Families (HUF) who run a proprietary business or are engaged in a profession. If you fall into this category, ITR-3 is the form you need.

Here’s an overview of ITR-3:

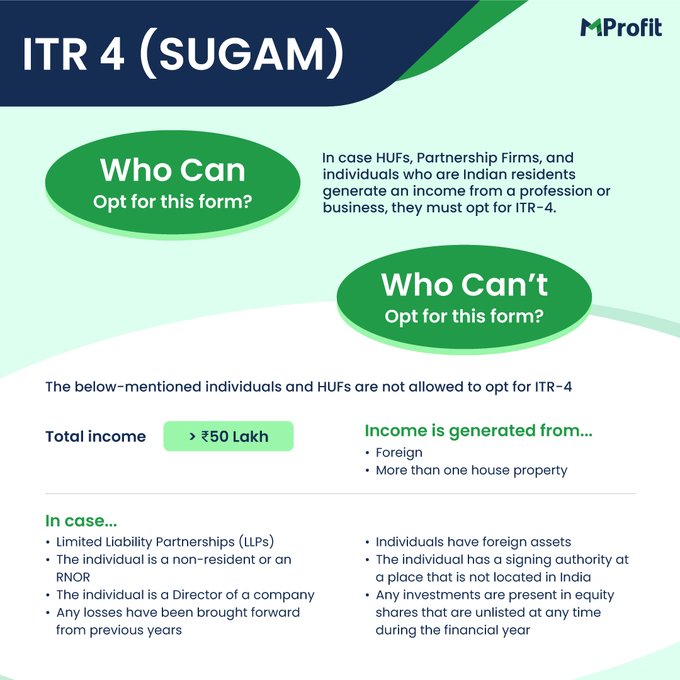

ITR-4 or SUGAM: For Handling Capital Gains with Ease

The Capital Gains Form Individuals, HUFs, and Partnership firms (except LLPs) with a resident status and total income under 50 lakhs can use ITR-4. This form is particularly useful for those reporting capital gains.

Here’s a summary for ITR-4:

ITR-5: For Firms, Associations, and More

ITR-5 is tailored for firms, LLPs, AOPs, BOIs, Artificial Juridical Persons (AJP), estates of deceased, estates of insolvent, business trusts, and investment funds. If you fall into any of these categories, ITR-5 is the form you need.

ITR-6: For Companies Except Charitable Ones

If you are a company (excluding those claiming exemption under section 11), you must use ITR-6 to file your returns electronically. This form is for companies that don’t fall under the category of charitable or religious purposes.

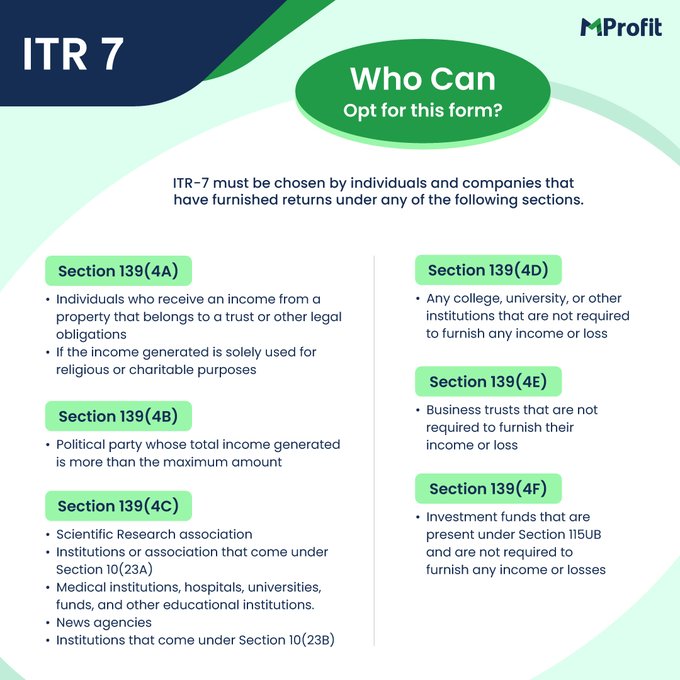

ITR-7: For Non-Individuals

ITR-7 is designed for entities other than individuals, such as trusts, political parties, or any other associations. If you represent such an entity, ITR-7 is the form you should use.

Here’s an overview of ITR-7:

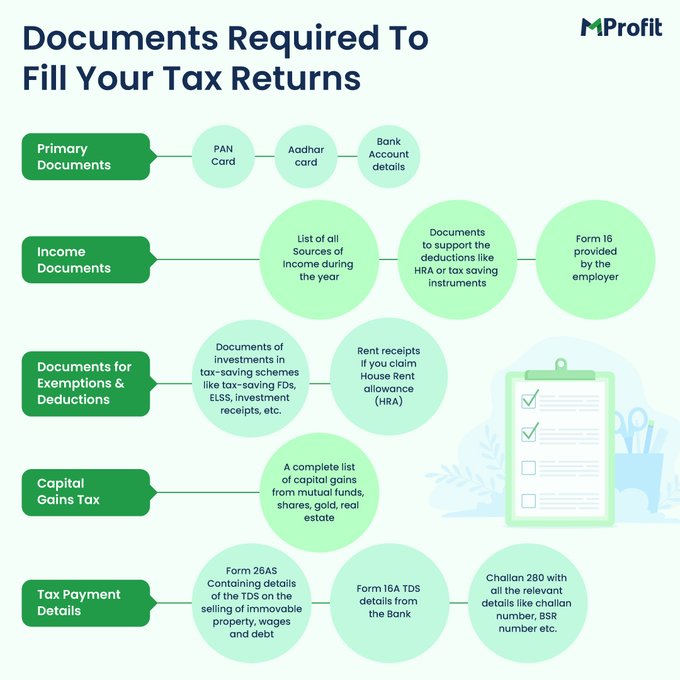

Important Documents You’ll Need

To ensure a smooth filing process, make sure you have all the necessary documents ready for each ITR form.

Here’s a broad list of documents you might need:

Conclusion

Don’t let the tax deadline worry you! Choosing the right ITR form is crucial to avoid complications and penalties in the future. We hope this blog has helped you understand the various ITR forms and determine which one suits your tax situation.

If you’re still unsure about which form to use, consult a tax expert for personalized guidance.

Happy filing!

Comments