In the ever-evolving financial landscape, New Fund Offerings (NFOs) bring forth new investment opportunities.

In this blog, we delve into why Asset Management Companies (AMCs) introduce new funds & the difference between new & existing mutual fund schemes.

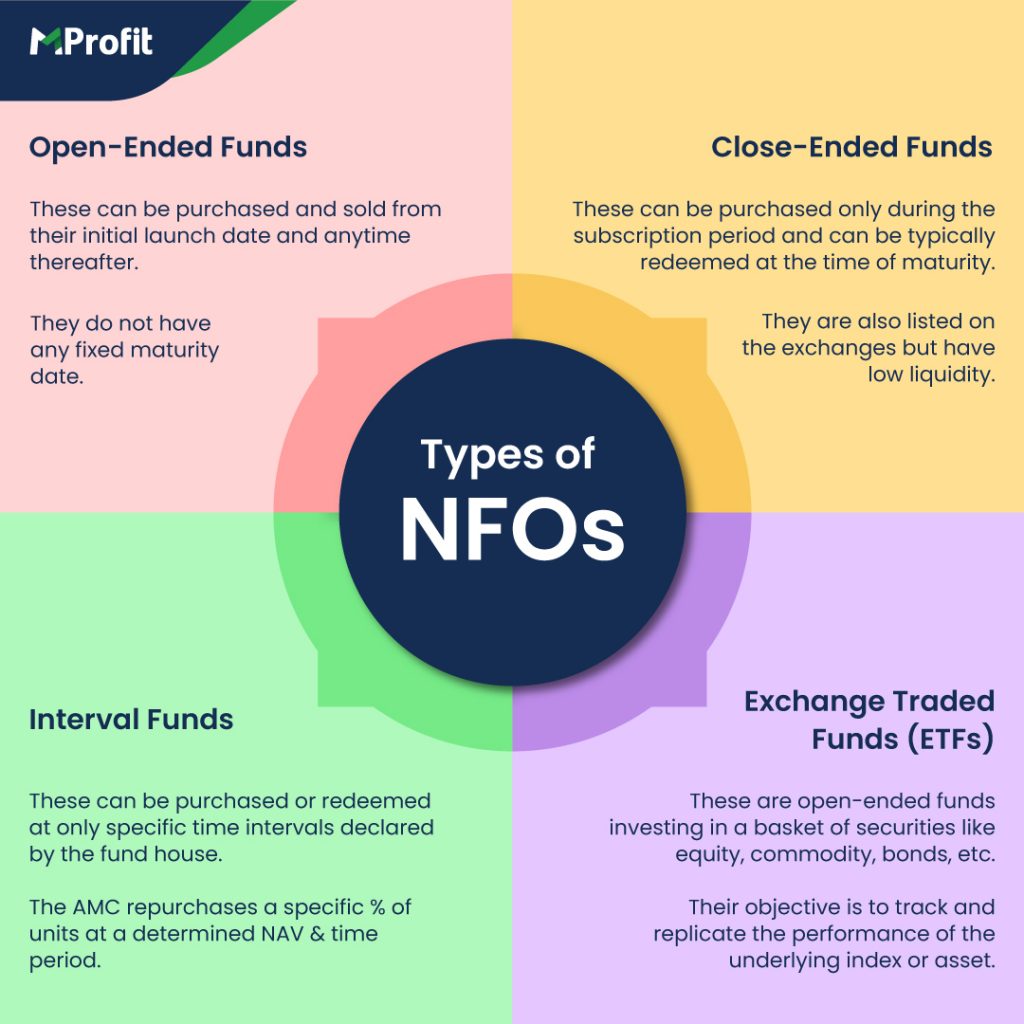

What are New Fund Offerings & their different types?

NFOs are new mutual fund schemes launched by AMCs with a specific investment objective or theme.

They offer diversified investment opportunities, cater to different risk appetites and capitalize on emerging trends.

Here are the categories of NFOs, along with their key characteristics:

How NFOs are different from existing MF schemes?

- NFOs are available for subscription at a predetermined initial price during a specific time frame.

- During the subscription period, the fund manager collects the funds from investors, which are then utilised for asset allocation.

- The investment process thereafter continues like the existing mutual fund schemes.

What are the key factors to be considered while investing in NFOs?

- New funds come with specific investment objectives like value, growth, capital appreciation, tax savings, regular income, etc.

- A lower Net Asset Value (NAV) doesn’t necessarily mean it’s a great deal to grab.

- The initial price is just the base price, & eventual fund performance shall depend on the underlying securities.

- As NFOs don’t have any past performance history, investors can review the other funds’ performance of the same AMC or the fund manager’s track record.

Conclusion

In the quest to achieve higher returns, you need to evaluate whether the new fund aligns with your risk appetite & fits within your investment budgets.

The more, the merrier does not always hold true in investment decisions.

Invest Wisely!

Comments