Welcome to the first instalment of our “Taxation Simplified” series, where we break down the complexities of tax filing to help you make informed financial decisions.

As the tax filing season for FY24 approaches, taxpayers are once again faced with a critical choice: should you stick with the old tax regime or switch to the new one?

This blog aims to demystify the differences between the old and new tax regimes, providing a clear comparison to help you decide which option best suits your financial goals and circumstances.

Whether you’re a seasoned taxpayer or filing for the first time, understanding these differences is essential to optimizing your tax liability and maximizing your savings.

Join us as we explore each regime, from the tax slabs and deductions to the exemptions and benefits.

By the end of this article, you’ll have the knowledge and confidence to choose the tax regime that suits your needs best.

Let’s dive in and simplify the process of tax filing together!

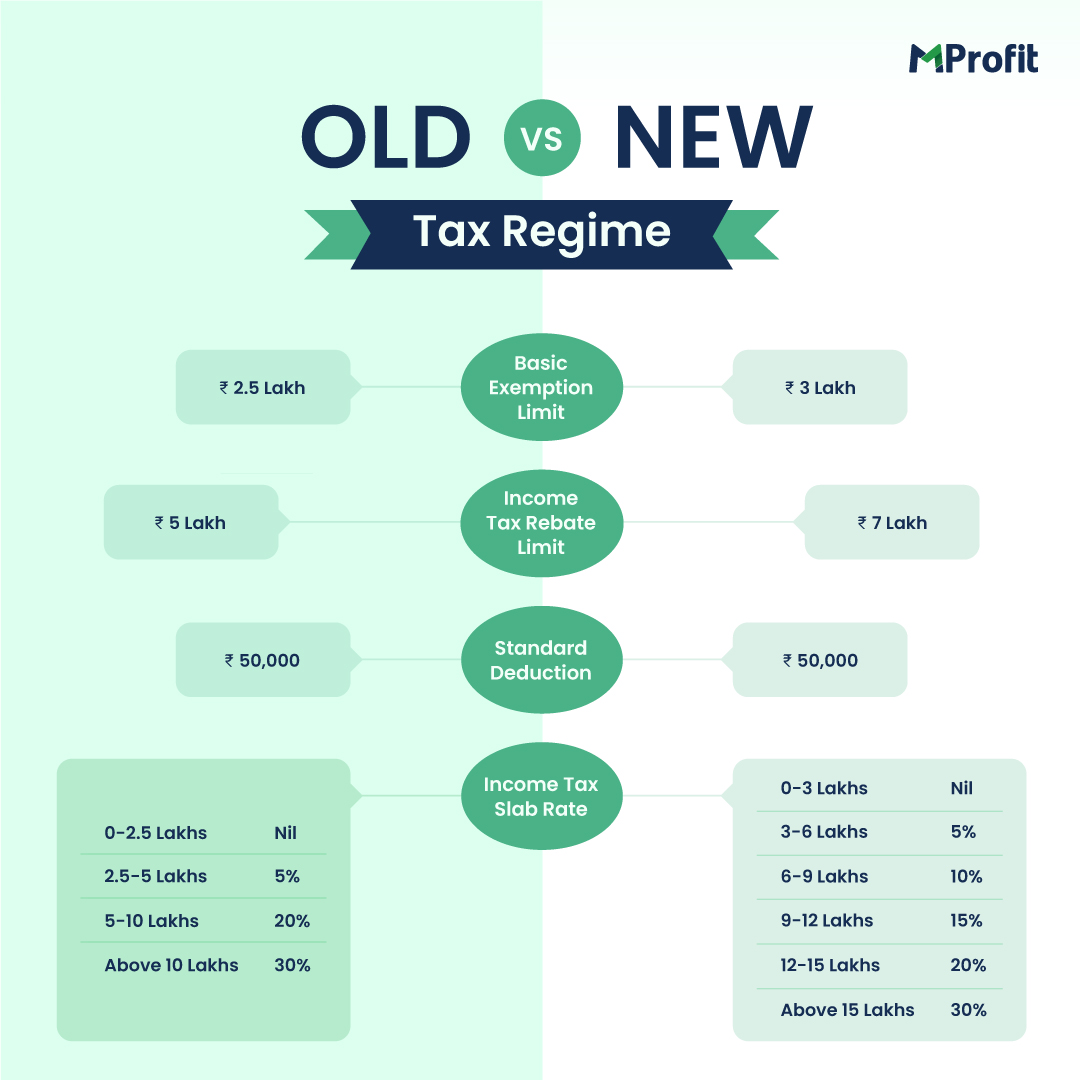

Differences Between the Old and New Tax Regimes

Old Tax Regime

- Higher Deductions and Exemptions: The old tax regime offers numerous deductions and exemptions.

- Complex Filing Process: It is more complicated in terms of tax filing due to the various deductions and exemptions.

New Tax Regime

- Limited Deductions and Exemptions: The new tax regime provides very few deductions and exemptions.

- Simplified Filing Process: It is simpler to file taxes under this regime.

Deductions and Exemptions

The new tax regime allows very few deductions compared to the old regime.

Here is a comparison of the deductions available under both regimes👇

Default Tax Regime

Since FY23, the new tax regime has been the default option for all taxpayers.

However, you can opt out of the new tax regime until the filing of the return for AY 2024-25.

Advantages and Limitations of Each Regime

Old Tax Regime

New Tax Regime

How to Choose Between the Two Regimes?

Choosing between the old and new tax regimes depends on your specific financial situation, particularly the amount of deductions you can claim.

Here are some examples to illustrate this:

Example 1: Mr. X

Mr. X has an income of Rs. 7.50 lakh with Rs. 2.50 lakh in deductions (section 80C + HRA) in FY23.

Under the Old Regime:

- Taxable income: Rs. 5 lakh

- Tax: Zero

Under the New Regime:

- Tax: Rs. 39,000

In this scenario, the old regime is more beneficial as the deductions significantly reduce the taxable income.

Example 2: Mr. Y

Mr. Y has an income of Rs. 9 lakh and claims no deductions in FY23.

Under the Old Regime:

- Tax: Rs. 96,200

Under the New Regime:

- Tax: Rs. 62,400

Here, the new regime is more advantageous due to the absence of deductions, resulting in a lower tax slab.

Conclusion

Both tax regimes come with their own set of advantages and disadvantages.

The choice between them largely depends on the number of deductions and exemptions applicable to your income.

As a general guideline, the fewer the exemptions, the more likely the new regime will be suitable.

While this blog provides a broad overview, it is important to remember that each person’s tax situation is unique.

Consulting a tax expert is recommended to ensure you make the best decision for your specific circumstances.

Happy tax filing season!

*Disclaimer – This is for information purposes only and not investment advice. Data credit to the rightful source.

Comments