Welcome to another edition of Taxation Simplified! As tax filing season approaches, investors must understand how their gains across various asset classes will be taxed.

Whether you’re dealing with equity, debt, mutual funds, gold bonds, real estate, or specialized instruments like REITs and InvITs, each asset class has unique tax implications that can significantly impact your overall returns.

In this blog, we delve into the complexities of capital gains taxation, providing a comprehensive guide on how different investments are taxed.

From short-term gains to long-term holdings, we’ll discuss different tax rates for different assets.

Join us as we explore the landscape of investment taxation, ensuring you’re well-prepared to maximize your after-tax returns this tax season.

What is Capital Gains Tax?

Capital gains tax is the tax on the profit or gain that arises from the sale of a capital asset.

This income is categorized into long-term capital gains and short-term capital gains, depending on the holding period of the asset.

Capital Gains on Equity Shares/Equity Mutual Funds

- Short-term capital gains: Holding period below 1 year.

- Long-term capital gains: Holding period above 1 year.

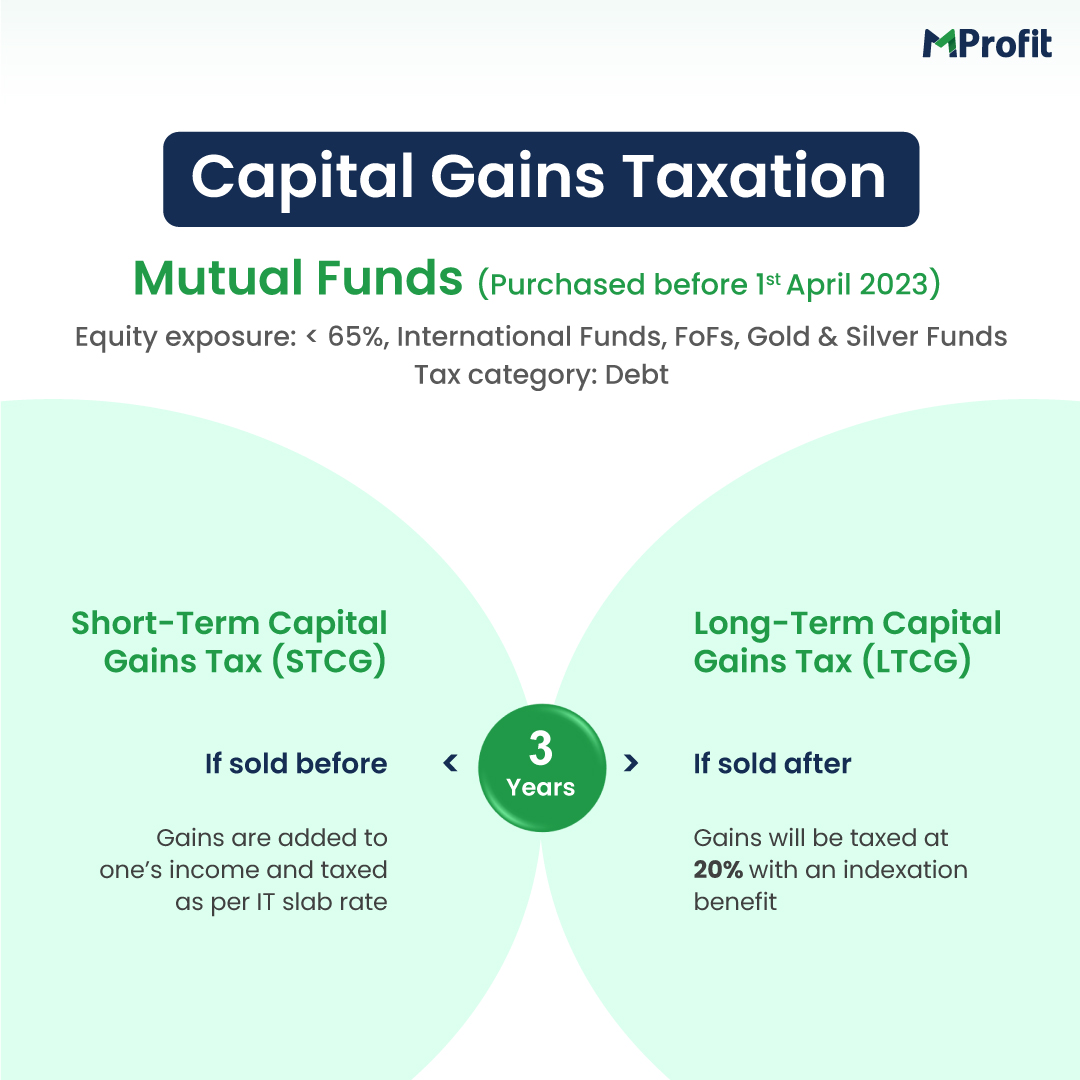

Capital Gains on Debt Mutual Funds

For Debt Mutual Funds Purchased Before April 1, 2023 (With Debt Exposure of More Than 35%)

- Short-term capital gains: Holding period below 3 years.

- Long-term capital gains: Holding period above 3 years.

For Debt Mutual Funds Purchased After April 1, 2023 (With Debt Exposure of More Than 65%)

- No differentiation between long-term and short-term capital gains tax rates.

For Debt Mutual Funds Purchased After April 1, 2023 (With Equity Exposure Between 35-65%)

- Short-term capital gains: Holding period below 3 years.

- Long-term capital gains: Holding period above 3 years.

Capital Gains on Gold Products

Taxation of Physical Gold

- Short-term capital gains: Holding period below 3 years.

- Long-term capital gains: Holding period above 3 years.

Taxation of Sovereign Gold Bonds

- Short-term capital gains: Holding period below 3 years.

- Long-term capital gains: Holding period above 3 years.

Capital Gains on Real Estate Products

- Short-term capital gains: Holding period below 2 years.

- Long-term capital gains: Holding period above 2 years.

Taxation of REITs/InVITs

- Short-term capital gains: Holding period below 3 years.

- Long-term capital gains: Holding period above 3 years.

Stay tuned for more insights in our Taxation Simplified series as we continue to simplify complex tax concepts for you!

Happy investing!

*Disclaimer – This is for information purposes only and not investment advice. Data credit to the rightful source.

Comments