Planning for retirement can feel overwhelming, but the National Pension Scheme (NPS) makes it simpler and more rewarding.

This essential retirement product is designed to help you build a substantial pension fund, ensuring financial security in your golden years.

The NPS stands out for its flexibility, tax benefits, and disciplined approach to saving.

Whether you’re just starting your career or are well on your way, incorporating the NPS into your financial planning can help you achieve a comfortable retirement.

In this blog, we’ll cover everything you need to know about the NPS—how it works, its benefits, and why it might be the perfect addition to your retirement strategy.

So, let’s dive in and explore how the NPS can help you secure a financially stable future.

What is NPS?

NPS is a voluntary retirement savings scheme designed to allow subscribers to make defined contributions towards planned savings, securing their future in the form of a pension.

Simply put, you contribute and invest in various asset classes to build a pension corpus.

This pension corpus can be redeemed at age 60 or upon retirement.

Applicants should be between 18 to 70 years of age as of the date of submission of their application.

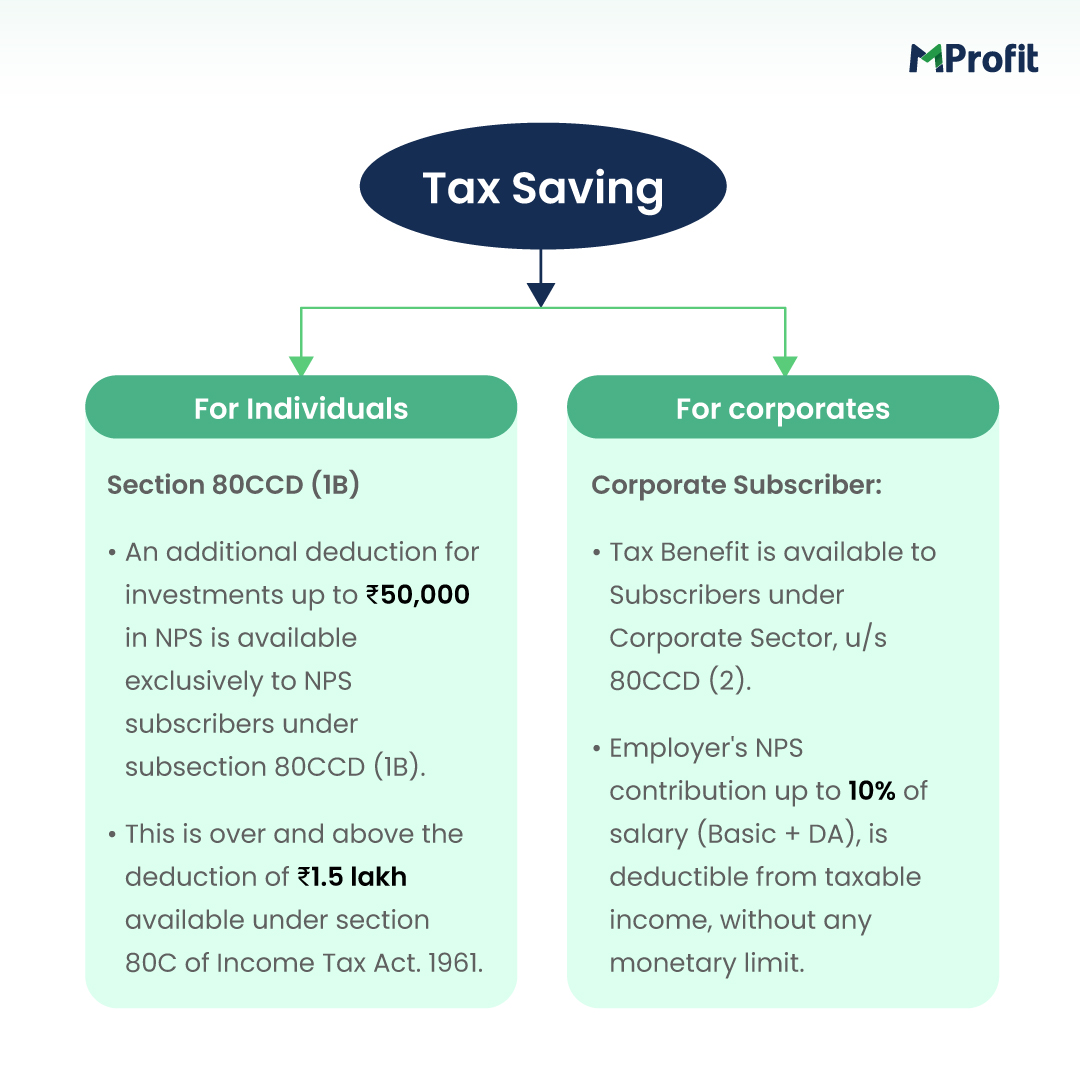

Tax Saving

Individuals who are employed and contributing to NPS enjoy tax benefits on their own contributions as well as their employer’s contribution.

Types of NPS Accounts

There are two types of NPS accounts:

- Tier 1 Account

- Tier 2 Account

NPS Investment Options

NPS offers different options for investing:

- Two Approaches: Active or auto fund management.

- Four Asset Classes: Equity, Debt, Government Securities, and Alternative Investments.

- Different Fund Managers

Here are the different types of asset classes one can choose from 👇

Choosing Between Different Asset Classes

When it comes to asset allocation in NPS, you have two options:

- Active Choice: You choose the asset allocation.

- Auto Choice: The asset allocation is done automatically based on your age.

Upon opening an NPS account, it is crucial to select a Pension Fund Manager.

The chosen manager will then take care of investing your funds into a variety of asset classes.

Premature Withdrawal

NPS has specific rules around premature withdrawal.

Here are the rules around premature withdrawal of NPS 👇

Withdrawal Rules

There are specific rules around withdrawal from NPS that need to be followed.

Here are the rules around Withdrawal from NPS 👇

Advantages of NPS

NPS offers several advantages, including flexibility in investment options, tax benefits, and a structured approach to retirement savings.

Here are the advantages of NPS 👇

Disadvantages of NPS

While NPS has many benefits, it also has some disadvantages that should be considered, such as restrictions on withdrawal and limited liquidity.

Here are the disadvantages of NPS 👇

Conclusion

The National Pension Scheme (NPS) provides a structured and flexible way to save for retirement.

With options to choose from different asset classes, fund management approaches, and fund managers, it offers a tailored approach to suit individual needs.

The tax benefits add to its appeal, making it a practical choice for many.

However, understanding the rules around withdrawals and the potential limitations is crucial for effective planning.

Overall, NPS can be a valuable component of a comprehensive retirement strategy, helping to ensure financial security in your later years.

*Disclaimer – This is for information purposes only and not investment advice. Data credit to the rightful source.

Comments